Poll positions

Labour candidate selection , Issue 1621

In October 2022, Labour MP Sam Tarry, a former shadow minister and ex-partner of deputy leader Angela Rayner, was deselected for the Ilford South constituency, with members voting 499 to 361 to select Jas Athwal, leader of Redbridge council.

Tarry is threatening to seek an injunction blocking Athwal from standing as the official Labour party candidate unless alleged voting irregularities are investigated by the party. Although Tarry received 57 percent of the in-person vote at the selection, he received just 35 percent via Anonyvoter.

Shifting opinions

A subsequent investigation by allies of Tarry raised further questions about the selection. A comparison of the addresses of those who voted against addresses on the electoral register revealed many irregularities.

A significant number of party members were not listed on the electoral register at the addresses on the party's membership list provided to Tarry. Some of the properties were rental properties, some in multiple occupation, owned by Redbridge councillors, including close colleagues of Athwal.

When Tarry and supporters knocked on the doors of the addresses in question, they were frequently met with the response that the members listed had moved out and had their post collected by other people.

Rigging rigour

Tarry is threatening legal action if Labour fails to release the Anonyvoter records. He wants a full investigation into alleged ID fraud and what the former shadow minister has called "vote-rigging".

Meanwhile the Eye asked the London Labour party to confirm or deny that the interim chair of Croydon East constituency Labour party, Carole Bonner, has been suspended by the party in connection with the investigation into alleged improper use of personal data re the parliamentary selection process. Answer came there none.

More top stories in the latest issue:

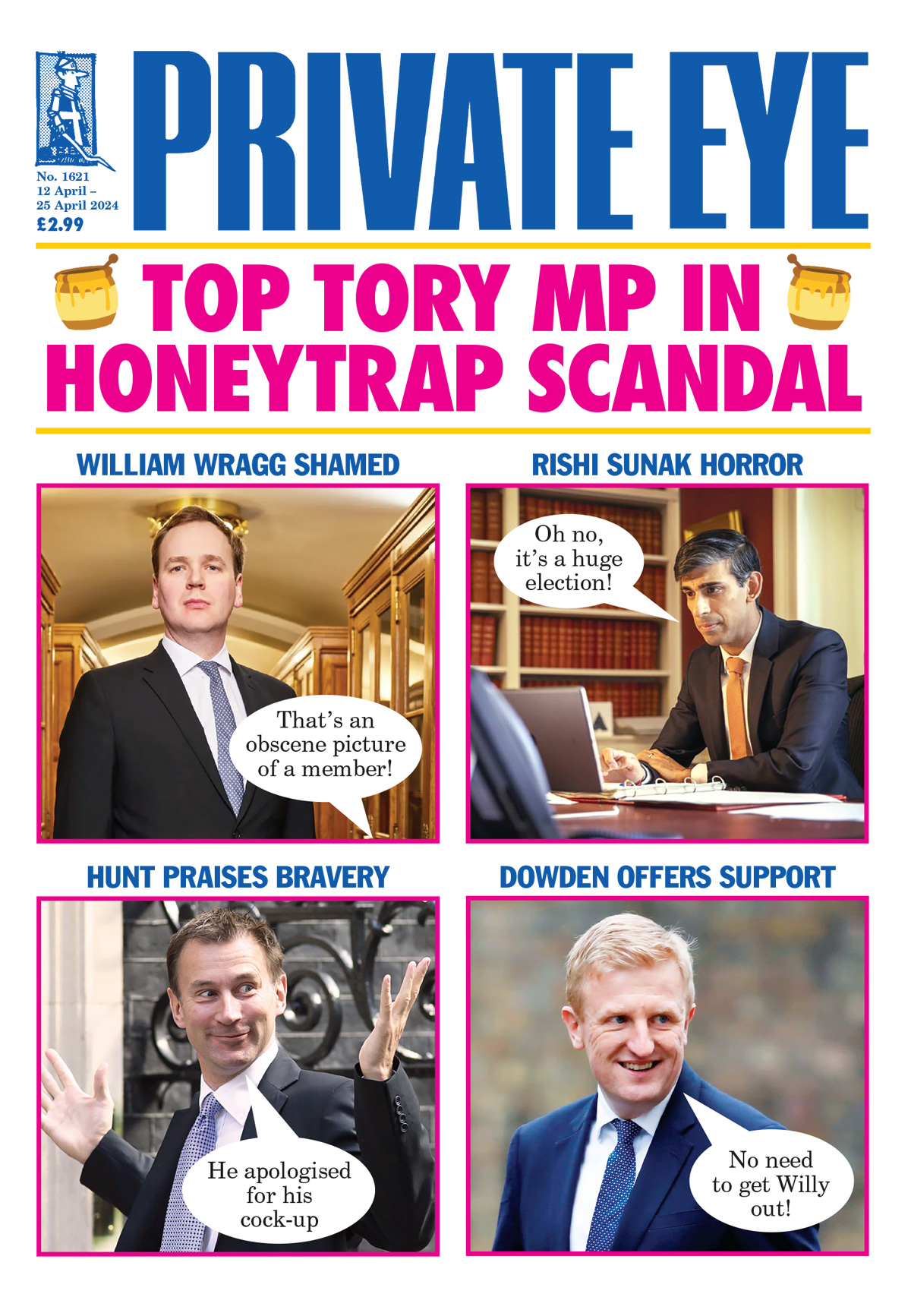

OILY WRAGG

What will fellow members of the Tory "common sense group", who don't like "snowflakes", make of Will Wragg's "I've hurt people by being weak" lament?

NATIONWIDE SCOURGE

A Nationwide ad campaign that tried to claim the moral high ground above other banks drew the ire of Santander and was subsequently banned.

GROK OF SHIT

With X's AI model Grok now summarising trending topics, the results have been alarmingly wrong, including "Iran Strikes Tel Aviv With Heavy Missiles".

PARTY LIE

Lord Houchen, standing for re-election as Tees Valley mayor, insisted: "I'm not directed, whipped or told what to do by any political party." Really?

NO PLACE LIKE HOME

The Mail on Sunday took aim at Angela Rayner over "the 'home' where she claims NOT to have lived" – despite its owner's own domicile arrangements.

TURD OF THE WEEK

United Utilities recently trumpeted improvements to its sewerage system – just before new data revealed that the company is in a literal shitstorm.

DEAD RUBBER

Yet another dodgy old commercial contact threatens to embarrass Lord Mandelson while he's busy lecturing the pre-government Labour leadership.