Top stories in the latest issue:

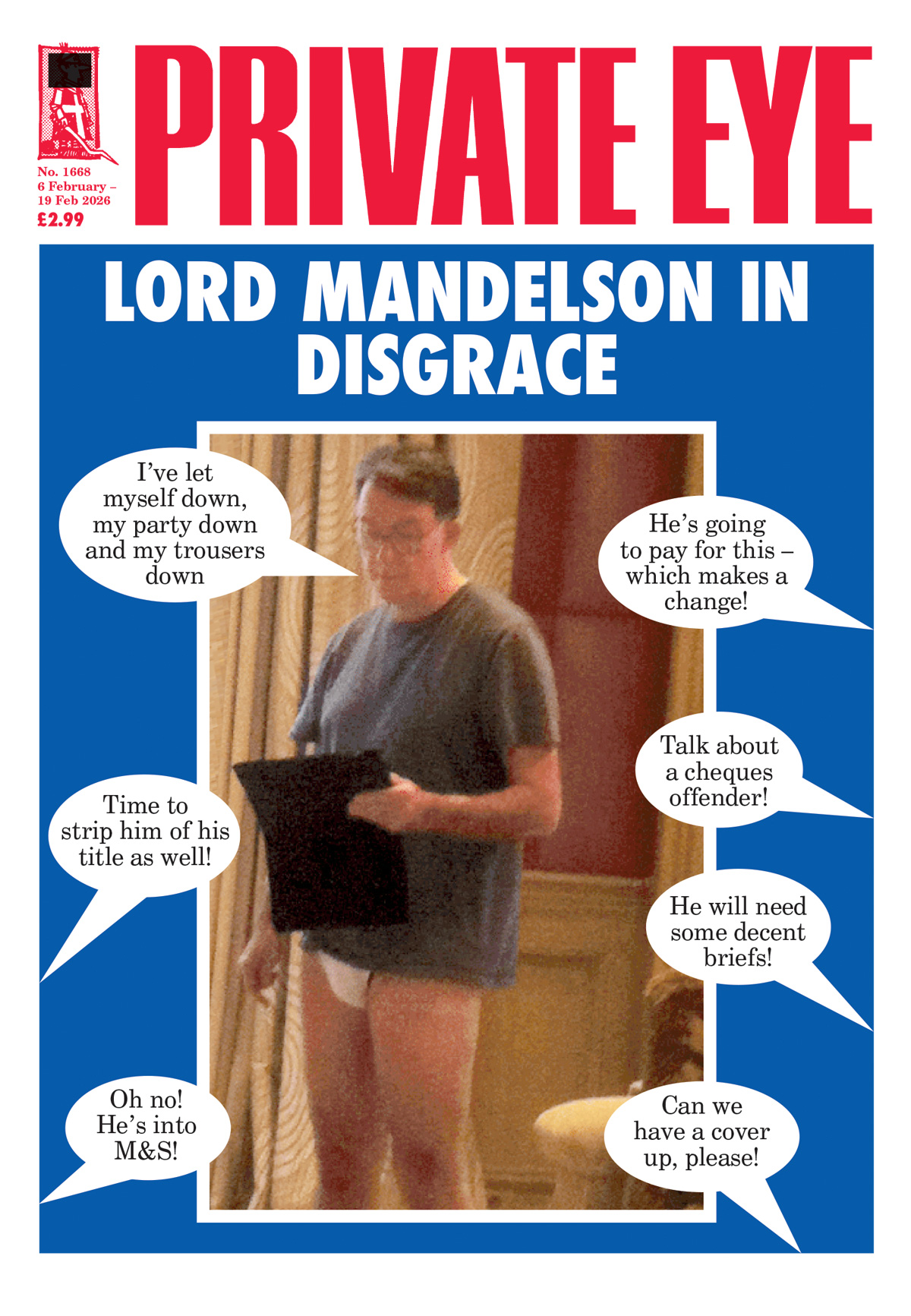

UNSOLICITED BEHAVIOUR

Solicitor Andrew Milne, whose ropey legal tactics the Eye had highlighted, has finally been held accountable – but by a court rather than by the regulator.

DRIVING FARCE

One man's experience shows how the Motability scheme is mercilessly efficient at removing vehicles from those it believes are not entitled to them.

PANIC STATIONS

Tree-burning electricity generator Drax is cutting 10 percent of its staff, and insiders believe CEO Will Gardiner will leave under cover of this restructuring.

DEATHLY QUIET

More than six years after two men were killed on the Tees regeneration project, justice for the men and their families appears as far away as ever.

CONTROL EXPERIMENTS

The College of Policing's new domestic abuse risk assessment (DARA) framework to identify coercive control may be doing more harm than good.

CAPITA PUNISHMENT

Capita's crap takeover of the civil service pension scheme has led to the government imposing penalties and offering hardship loans to retired staff.

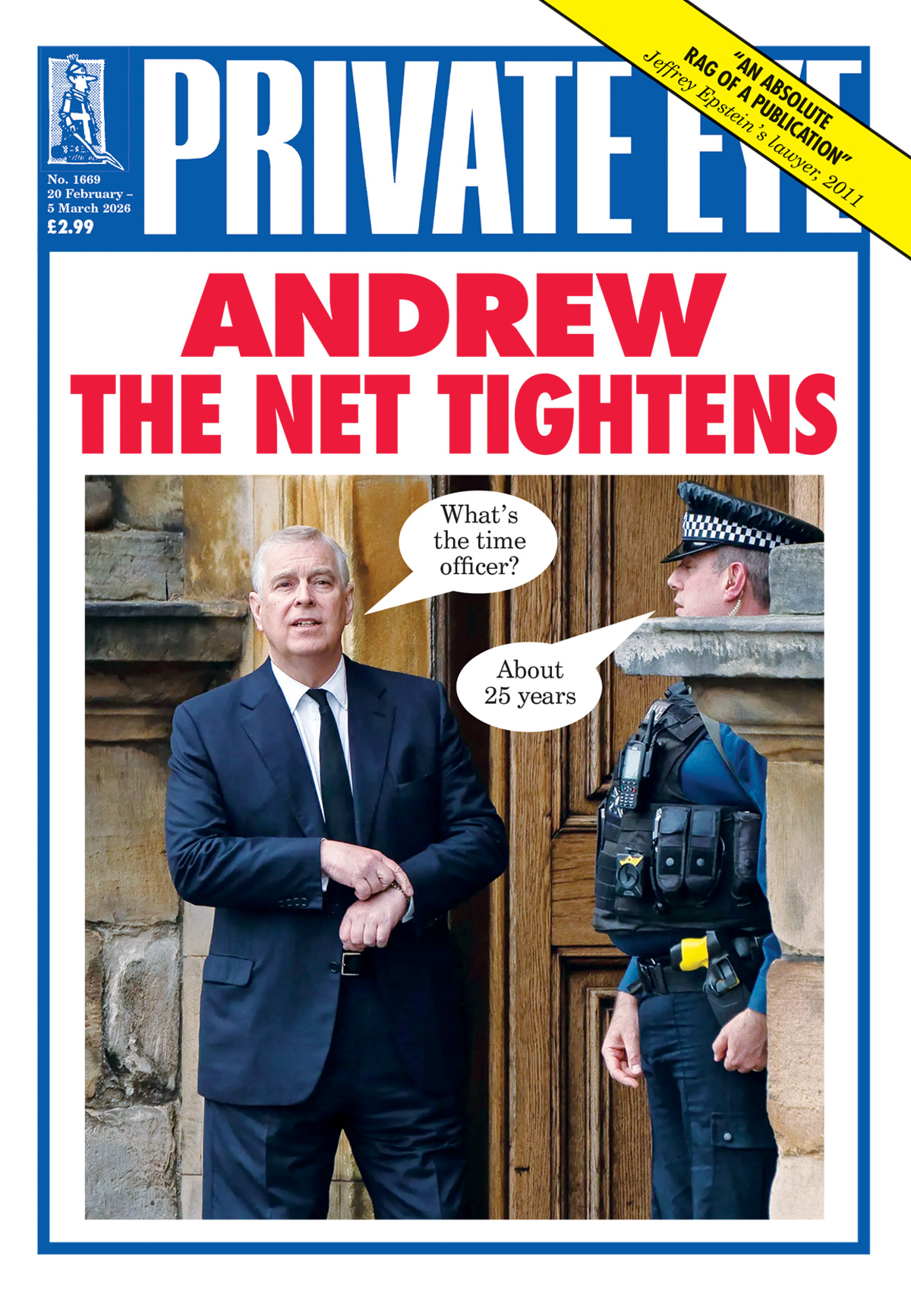

TARNISHED JEM

Emails in the Epstein files reveal that the University of Cumbria's Institute for Leadership and Sustainability sought funding from the disgraced financier.

TEFLON DONS

Students at Oxford University have called for a safeguarding review after learning that a professor accused of rape still has full access to their college.