Harsh reality

Children in care , Issue 1651

The Real Housewives of Cheshire reality-show regular announced she would be "sharing her truth" over her heartbreak at the decision with the Sun. "Happy bank holiday weekend you strikingly beautiful mother f**kers," she wrote on Instagram. "Pictures don't reveal what's going on inside anyone's mindset."

The heartfelt message was accompanied by a picture of herself bending forwards in a low-cut and mainly transparent dress, pouting provocatively.

Curbed appeal

During her appeal against Ofsted's decision to shut down her home for "very vulnerable" girls with emotional or behavioural difficulties, Pickston's soft-porn modelling did not feature in the evidence against her. Nor did her engagement to porn baron David Sullivan, who financed the business, AP Care Homes, but had no involvement in the day-to-day running.

The care tribunal did, however, hear that Pickston threatened to stab a member of staff in the eye and tried to make others sign fraudulent documents – both claims she denied.

It also heard that staff left frequently, that some were not properly trained or screened, and that Pickston breached regulations by managing the home at times despite being ruled out as a fit person to do so; also that girls reporting sexual abuse, pregnancy and bullying, going missing and risky online behaviour were not recorded or properly followed up.

Pickston took a resident to her own home to look for her missing dog (Eyes passim). One former member of staff told the hearing children "came to harm and were at risk of harm".

Cheshire catch

Pickston opened Moss Farm Children's Home, in Styal, Cheshire in June 2023, saying it would be the first of many children's homes. Just five months later, Ofsted visited after complaints about inappropriate social media posts, rated the home inadequate and suspended its licence, finding "serious and widespread concerns" about safeguarding, leadership and management.

It was briefly allowed to reopen after complying with regulations but was almost immediately closed again over further safeguarding issues.

Chilling words

As well as launching an appeal on behalf of her company, Pickston has pursued the three visiting Oftsed inspectors personally through the courts – an approach Judge Siobhan Goodrich said could have a "chilling effect" on statutory regulation designed to keep children safe.

Concluding, Judge Goodrich said Pickston's lack of insight into the risks, denial of any harm done, "strong personality" and combative record with staff and Ofsted were unlikely to change, meaning she was not an appropriate person to run children's homes.

After the Sun failed to publish her "truth", Pickston accused Ofsted of intimidation, bias and blackmail. She is believed to be continuing her lawsuit against the individual inspectors. Her lawyers were contacted for comment, while Sullivan said it was "nothing to do with" him.

More top stories in the latest issue:

BABY FORMULAS

Various baby products will soon no longer need poisonous flame retardants to be sold in the UK, but progress on protecting everyone else remains slow.

A FINE MESS

Women who are visibly pregnant but don't have the paperwork to prove it are among the thousands of patients issued with £100 fines for prescription fraud.

SOFT OPTION

Evidence obtained by the Eye raises doubts about the official justification for the Teesside regeneration deal which has so enriched local businessmen.

VIOLET DISORDER

A big purple block of student flats in Cornwall is still half-built and under wraps after contractor Caledonian Modular went under in 2022.

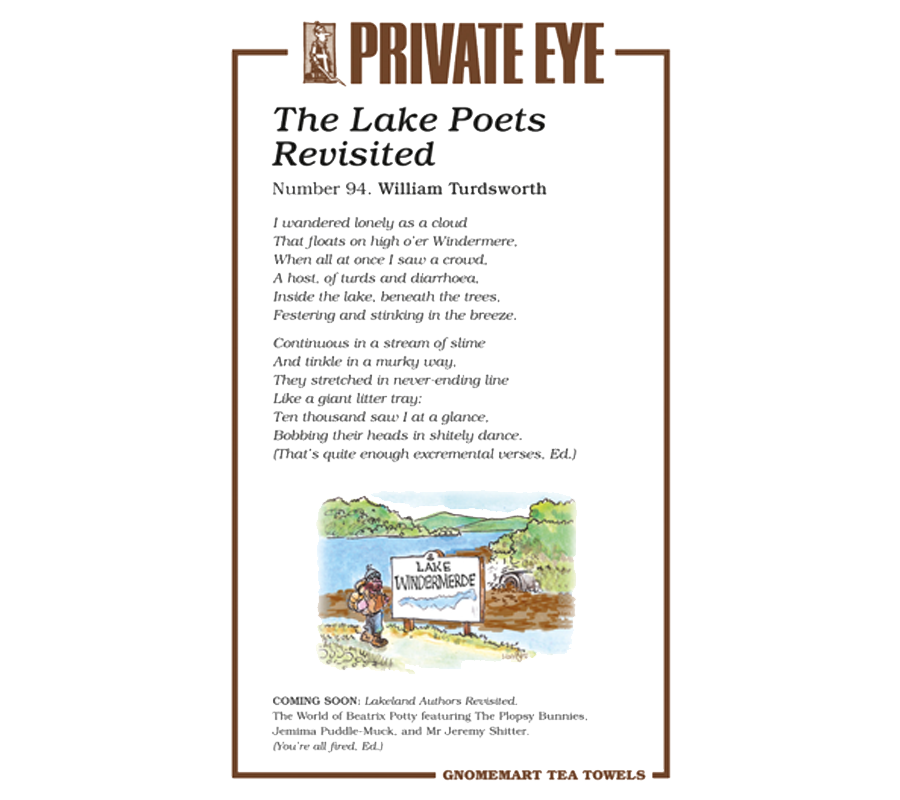

TURD OF THE WEEK

Trouble at Maids Moreton in Bucks, where a 170-home development has been given the go-ahead despite local sewage works already being far over capacity.

PISH & BECCS

Yorkshire tree-burning power generator Drax shows signs of giving up on the UK, lured by visions of untold wealth abroad thanks to consultancy McKinsey.