Top stories in the latest issue:

FRAUD FIESTA

No one in government seems to know how much has been recouped from the voluntary scheme to claw back wrongly paid Covid support.

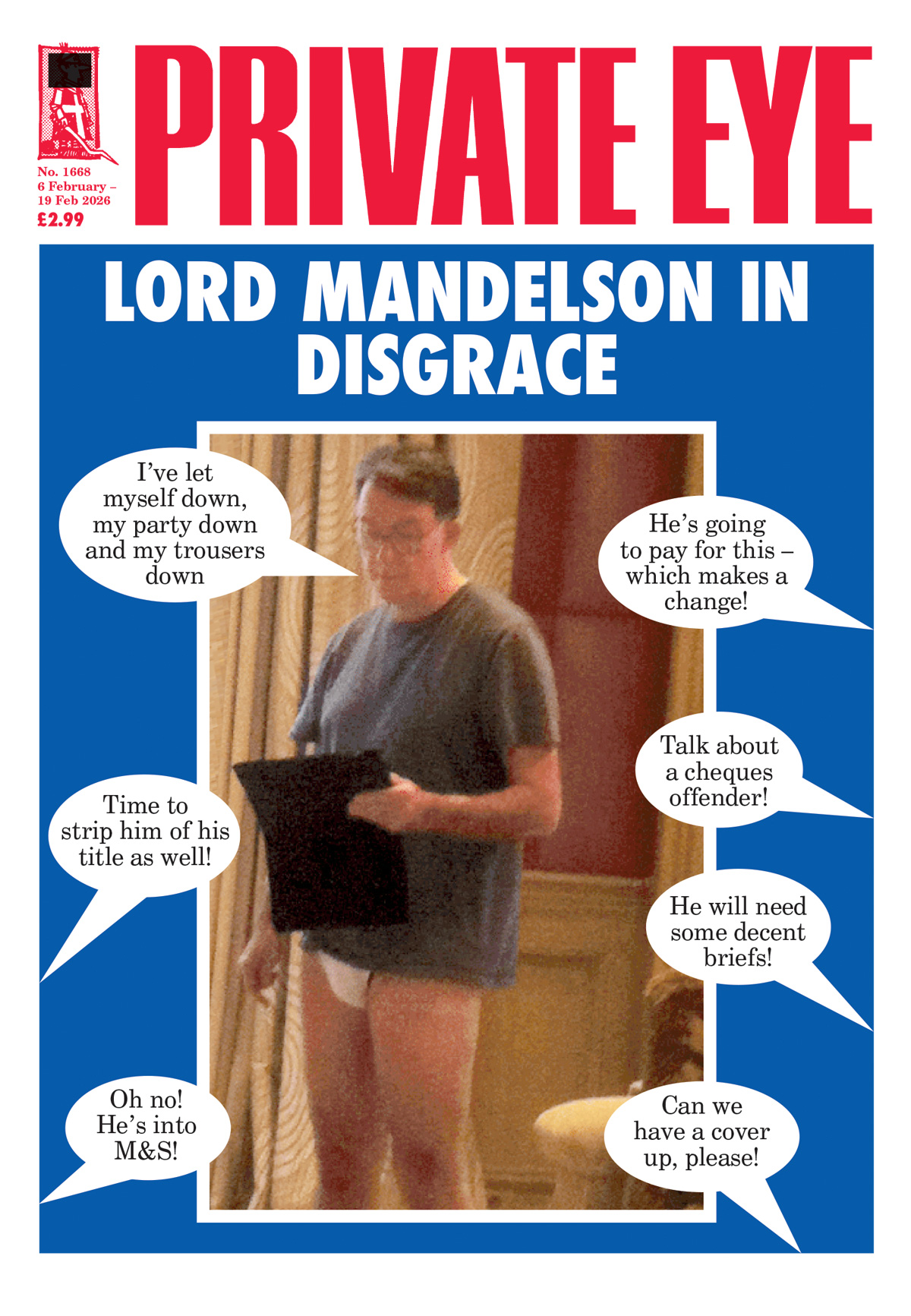

RAKE'S PROGRESS

"Moderate" Labour group Progressive Britain has tried to disassociate itself from Peter Mandelson, but in truth the ties run deep.

FAULDING PATTERN

Matt Faulding, the Lord Alli-linked Labour official who had a formal role selecting candidates for the 2024 general election, is now a lobbyist for Anacta.

ODEY, OH DEAR...

Senior Reform UK figures took aim at Keir Starmer for having appointed Peter Mandelson US ambassador – but they should take a look in the mirror.

CALLED TO ORDURE

Passive-aggression levels were high in the Lords as "respectful" peers spent another long Friday debating the assisted dying bill.

LOCAL ZERO

Robert Jenrick has led Reform UK's attacks on the government over its attempt to cancel some council elections – but he had a very different view in 2021.

LAI IN WAITING

Hong Kong industrialist Jimmy Lai's 20-year jail sentence says much about Keir Starmer's lobbying of Chinese president Xi Jinping on his behalf.

PARTY CRASHERS

Internal elections for Your Party's central executive committee have done nothing to heal the divisions within the left-wing party.

MUSK'S RAT

Rupert Lowe and his Restore Britain party have the backing of Elon Musk – and Lowe has returned the favour with a bizarre comment in the Commons.