Top stories in the latest issue:

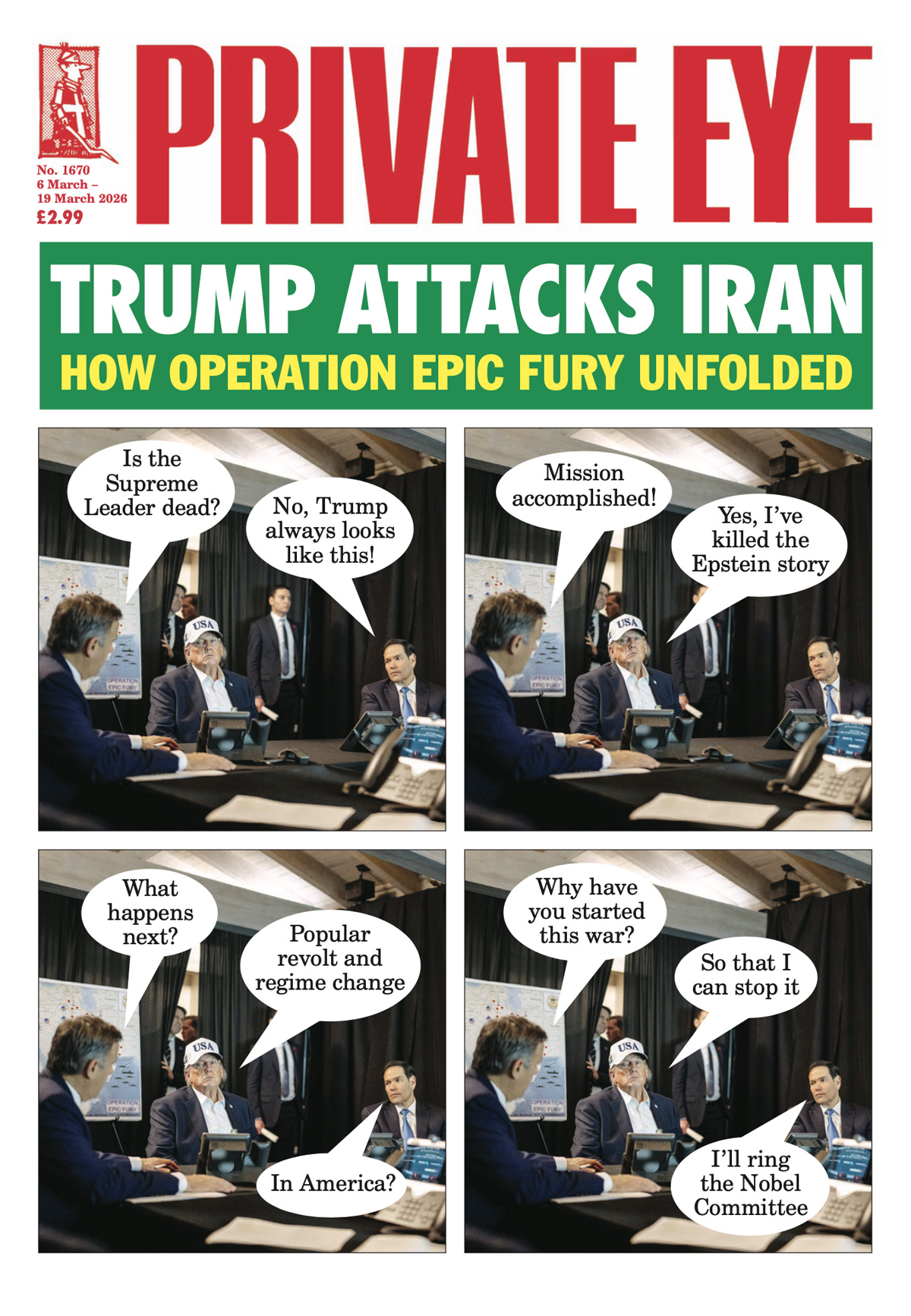

US-EYE

Donald Trump may have bombed Iran simply because he felt like it, but on past form he will soon tire of that war, while his war on woke is eternal.

STARMER CHAMELEON

In his Labour leadership campaign, Keir Starmer made much of his backing for campaigners against the UK hosting US military bases. How times change.

CHAGOS CHAOS

The bombing of Iran added to the US-inspired complications over the fraught deal to hand over the Chagos Islands to Mauritius.

BLITZ SPIRIT

As Iranian missiles rained down on the UAE, were the high-profile Brits who relocated to the tax haven regretting their choices? Not publicly…

VIENNESE SCHMALTZ

In his memoir, The Third Man, Peter Mandelson unwisely plays up the similarities between himself and Graham Greene's shadowy villain.

GLOBAL CANCEL

While Mandelson himself won't be hit financially by his old lobbying firm's demise, US consultant Jim Messina, who invested in 2024, can't say the same.

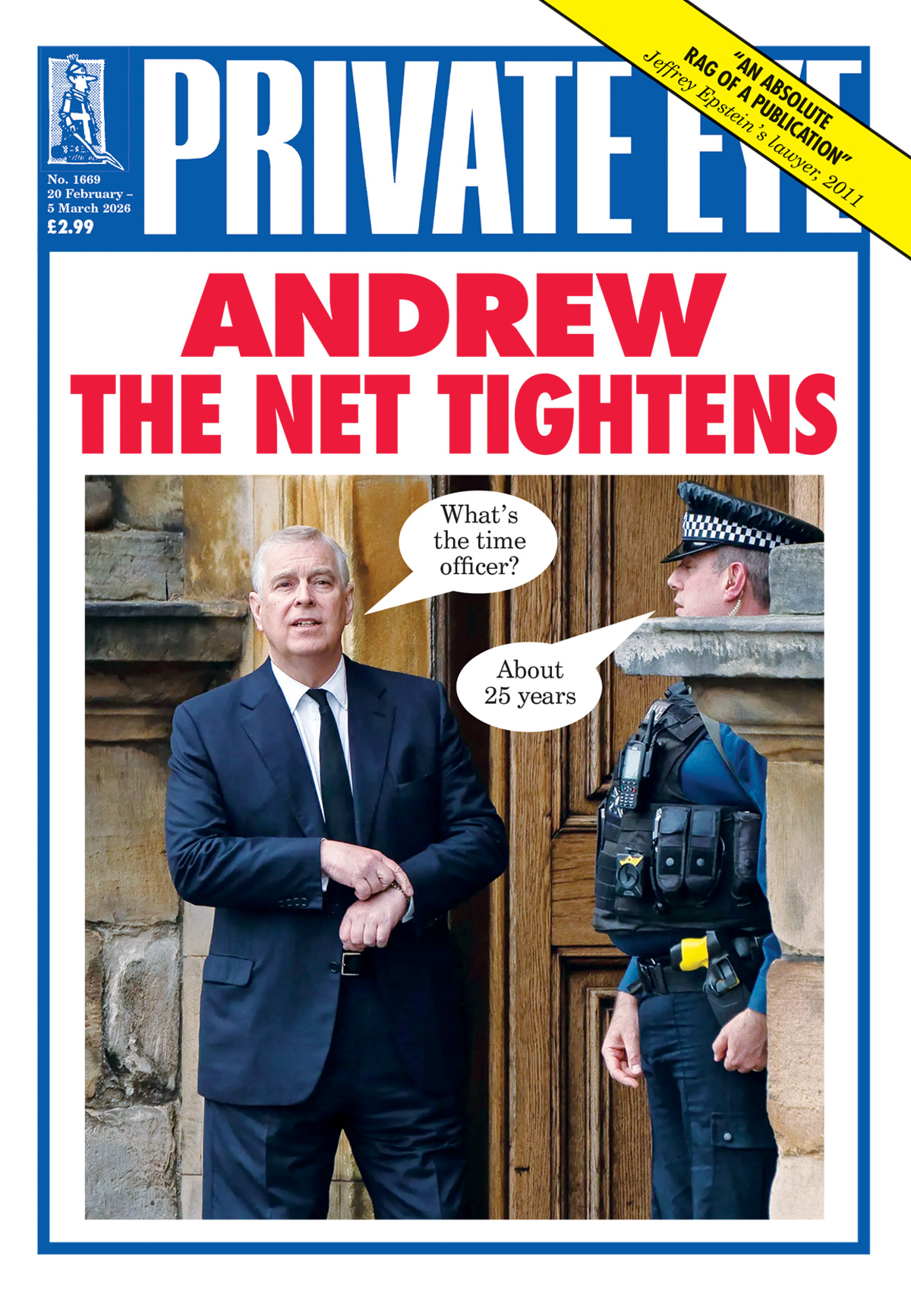

COURT CIRCULAR

Claims the palace hadn't been warned about Andrew's arrest are inaccurate. The previous night a flunkey took an urgent call about "something huge".