Have we got more pews for you!

Church News, Issue 1653

The Archbishop of Wales Andrew John has announced his sudden retirement, admitting "shortcomings and poor organisational practice which shouldn't have happened", which he had not addressed quickly enough.

Bangor out of order

The Charity Commission has launched regulatory compliance cases into both the Bangor Diocesan Trust and the Dean and Chapter of Bangor Cathedral, after serious incident reports were filed. Concerns flagged included jollies to Rome and Dublin for cathedral clergy and staff, and the purchase of more than £400,000-worth of designer pews and other furniture.

Concerns over safeguarding were also flagged in a report by an independent charity. Only the summary was published, but even that was damning, revealing a culture of excessive boozing after services, blurred sexual boundaries and inappropriate language and behaviour.

Right mess

Local MP Ruth Jones has called for publication of the full report, "because unless you know what's gone wrong, how can you put it right?" The church says this isn't possible because those who were interviewed for the report had an expectation of confidentiality.

Last week, trustees of the representative body of the Church in Wales warned both the cathedral and the diocese that funding depends on demonstrating financial controls and safeguarding procedures are in place, so charitable assets are only "used to further the Church's mission and benefit the public in a manner consistent with our values and legal obligations".

They also urged the cathedral to commission another external investigation, specifically on "the behaviour, culture and activities of the cathedral choir", following the issues mentioned in the report summary around drinking, as well as "inappropriate language, rude jokes and innuendoes" in the presence of child choristers.

More top stories in the latest issue:

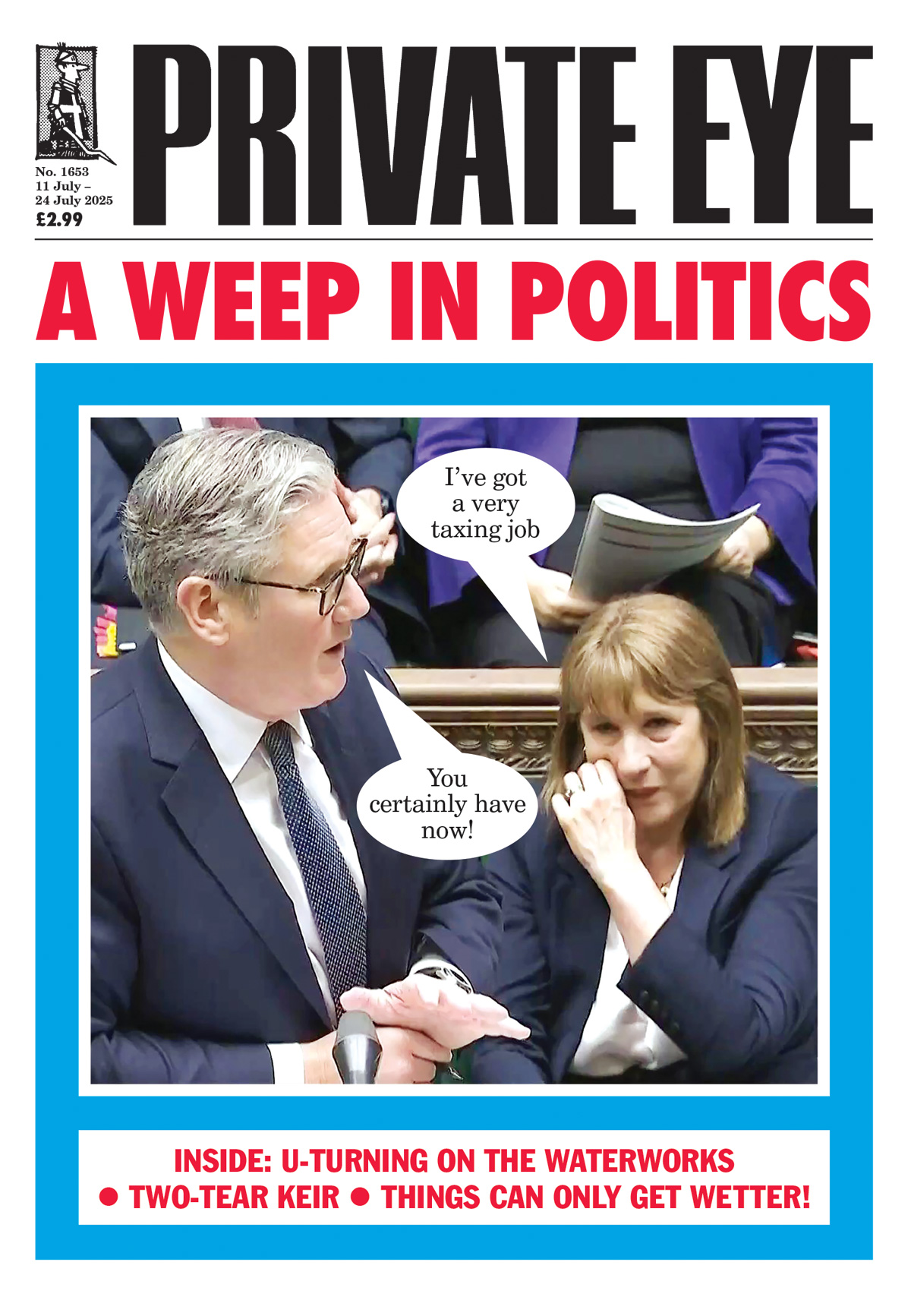

IRON DEFICIENCY?

The whole sorry benefits saga could be put down to the chancellor's pre-election promises of "iron discipline" on debt while keeping taxes down.

APP OINTMENTS

Labour's NHS vison has some good intentions, a lot of waffle and no delivery plan. Can a new tool in the NHS App really help everyone live healthier lives?

PRIVATE PRACTICES

The government's new 10-year strategy for infrastructure gives plenty more hints that the disastrous private finance initiative is on its way back.

TURD OF THE WEEK

Troubled Southern Water secured a £1.2bn bailout from owners Macquarie last week, but is still pinching the pennies at a Southampton property development.

DIRTY LAUNDRY

Little incentive for solicitors to pull their socks up as US-based law firm Steptoe International commits "multiple breaches" and faces… £600 costs and a rebuke.

MAST, ER, PLAN

Having inundated Scottish planning with applications for large telecoms masts in the middle of nowhere, the government has whittled them down to just 44.

POWER HUNGRY

Google's 10th environmental report, quietly published in late June, shows its emissions up more than 50 percent since 2019 – 6 percent in the past year alone.